Needless to say, one thing that we are all experiencing on our skin: these are days of intense and abnormal heat.

This is something different than the usual cliché of every summer, so you swear you have never suffered the heat so much. This time the numbers speak: a few days ago, in the province of Syracuse, it reached 48,8 ° C. This is none other than the highest temperature ever recorded in Europe.

In this time, at least one news that gives some relief is there. And that's what the air conditioners bonus is about. Even if in reality we should talk about mobile bonuses, the measure included in the budget law, which also includes tax breaks for the purchase of an air conditioner.

Let's find out what the 2021 air conditioners bonus is, who is eligible and how you can request it.

The air conditioners bonus

The furniture and household appliance bonus provided for by the 2021 Budget law also allows you to purchase air conditioners.

The tax advantage, which will be valid until 31 December 2021, it ranges from 50 to 65% for the purchase of a new appliance, and does not necessarily require a building renovation.

But why does the deduction fluctuate? Because it can be 50% if combined with home renovation (thus falling within the restructuring bonus) or with extraordinary maintenance (furniture bonus). In both cases, the maximum spending limit will be 16.000 euros.

If, on the other hand, the purchase of a new appliance is not linked to any type of intervention, the subsidy can rise up to 65%, with a maximum spending ceiling of € 46.154. However, the air conditioner must belong to a higher energy class.

Who is entitled to the air conditioners bonus

The air conditioners bonus, or more properly mobile bonuses, it can be requested in the tax return and without income or Isee limits. Both by natural persons (or by their cohabiting family members such as spouses, parents and children) and by art and professions exercisers, by partnerships and capital companies, professional associations, condominiums, autonomous institutions for public housing and cooperatives of dwelling with undivided ownership.

Air conditioners bonus: 50% discount

The furniture bonus combined with a renovation allows you to deduct 50% of the purchase of an air conditioner. Provided that in the context of construction works, which are carried out in the home or in the common parts of condominiums. The deduction must therefore be associated with the request for the 2021 restructuring bonus.

The new air conditioner model must be energy efficient. The certification of the producer (or plumbing and heating) is mandatory, indicating an energy saving.

Air conditioners bonus: 65% discount

You can benefit from this tax advantage even without carrying out a building renovation. In this case, it is necessary to buy or replace your energy-saving air conditioners (or air conditioners or heat pumps).

In concrete terms, proof of the increase in the energy efficiency level of the buildings must be submitted for this type of request. And in case of replacement of the existing system, the new appliance must belong to a higher energy class than the previous one.

Ten tranche formula or immediate discount

The discount is valid for purchases made by 31 December 2021.

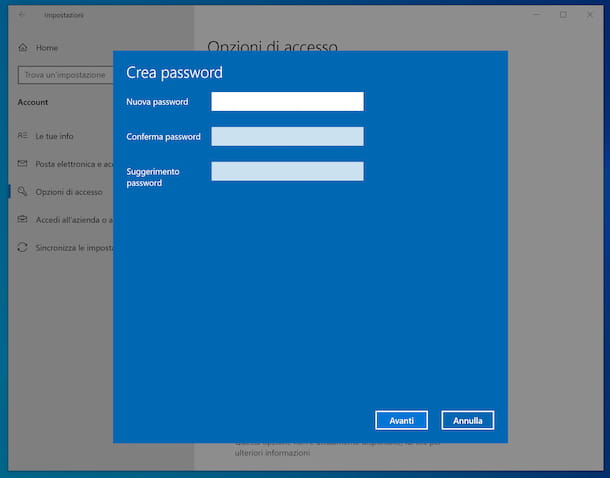

The air conditioners bonus must be requested in the tax return, by presenting the 730 model or the Unico.

The deductible amount must be divided into 10 annual installments, and includes transport and installation costs, provided they are made by bank transfer or credit or debit card.

There is also the possibility to request an immediate discount, if you pay by bank or postal transfer, or with the so-called talking bank transfer.

The deduction is valid even if the appliance was purchased with an installment loan, showing a copy of the payment receipt. Payment by check, on the other hand, does not entitle you.

The declaration to Enea

To take advantage of the air conditioners bonus, a communication must be presented to Enea (National Agency for New Technologies Energy Sustainable Economic Development) specifying the work carried out and demonstrating that energy savings have been achieved. The communication, to be submitted within 90 days from the end of the works, must be completed online on the page of the Enea website dedicated to renovations.

ARGO Ecolight 12000 Split System Air Conditioner White 365,00 EUR Buy on Amazon

ARGO Ecolight 12000 Split System Air Conditioner White 365,00 EUR Buy on Amazon

Records to be kept

To be in compliance with the tax relief proof of payment must be kept (bank transfer receipt, transaction receipt if paying by credit or debit card, debit documentation on the current account) and purchase invoices. The receipt with the buyer's tax code is equivalent to an invoice.