Although the electronic invoicing obligation has been in force since 1 January 2022, untangling the many software created to manage this important operation is not at all simple and requires a minimum of attention to compare the various resources available. I am sure that in your opinion the topic is of absolute importance, because you too, like all commercial and professional operators, would like to have clear ideas on which of the many electronic invoicing programs use.

For this reason, you are looking for advice on which software to use, right? Then do not worry, because with this post I have decided to offer you a specific guide, in order to show you the main software for electronic invoicing, their most important functions and their costs.

Courage: take a few minutes of free time, carefully analyze the solutions listed below and try to find the one that best suits your needs, so you can immediately start using it for your electronic invoices. That said, all I have to do is wish you a good read and a good job!

Index

Preliminary information

Before talking to you in detail about the electronic invoicing programs to whom you can contact, it seems only right to give you some information about this technology and its use in 2022.

The electronic invoice is a mandatory tax document which allows to certify a purchase and sale of goods and services between two subjects. In turn, the invoice regulates the debt and credit relationship that arises between buyer and seller.

As you already know, the electronic invoice fulfills the same obligations and the same functions as the old paper invoice, with the only differences that it must be drafted with a PC, tablet or smartphone and which must be sent electronically to the customer via the Interchange System (Sdl) in XML format (eXtensible Markup Language).

The SDL has been prepared by the Inland Revenue to check the presence of the mandatory data of the invoice, the electronic address and the correctness of the VAT number and the tax code of the seller and buyer. Precisely for this important function, electronic invoicing management software must exceed high quality standards because their reliability is necessary.

Electronic invoicing is mandatory, but some subjects are exempt from its issuance. Among the exempted, there are companies and self-employed workers who fall within the benefit scheme, those who fall into that flat rate and small agricultural producers (already exempt from billing). If you want more references, consult the dedicated page of the Agenzia delle Entrate website.

Free electronic invoicing programs

Having made these necessary premises, I can now tell you about the electronic invoicing management more used and reliable, able to simplify the sending of these tax documents to the Exchange System and to fulfill the legal obligation of their issue.

I'd like to start by telling you about those free programs created for electronic invoicing and supplied at no cost: these are reliable programs despite the fact that they are free of charge, ideal especially for those who do not need to make a large number of invoices.

Revenue Agency electronic invoicing program

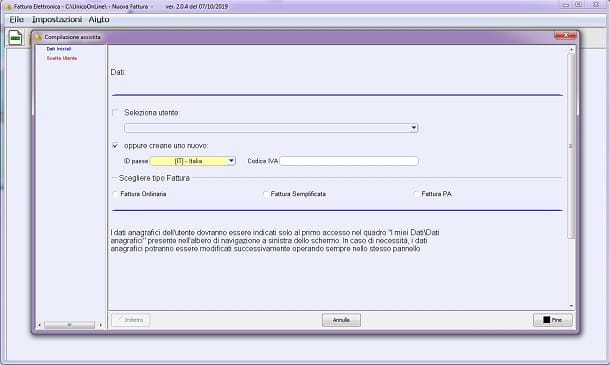

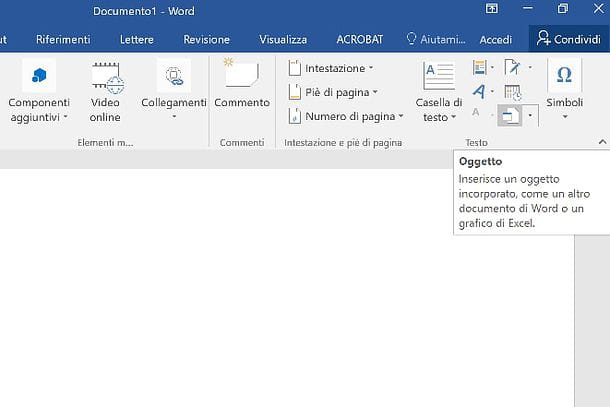

To use the free electronic invoicing software provided byInland Revenue, which allows you to compile the invoices through a series of questions that determine the structure of the XML file to be transmitted to the Revenue Agency, you must first install Java on the PC: if you have not yet done so, follow the specific guide I have published on the site.

Once this is done, you can proceed with the software download. Therefore, connected to the dedicated page on the AdE website and click on the link Compilation of electronic invoice, to start downloading the program immediately.

Once the download is finished, open the file named FEL18.jnlp, with a double click, and complete the installation by clicking on the buttons Run e NEXT.

The software is now ready to be used: once started, just click on the icon blank document with the word New, located at the top left, or on the menu Fillet (top left) and then on the item New invoice, to create a new electronic invoice.

Now you can enter the VAT code and put a tick the type of invoice that you want to create between Ordinary, Simplified e PA. When you want to confirm the data, click on the button Finished.

The next step requires you to enter your details, by clicking on the folder on the left called My data, and then go to the folder Invoice, to enter customer data, then ai General data and insert both the Detail lines of the invoice that i Payment data. In order to complete the invoice, you will need to view the Summary data and finally confirm by pressing the button Creation of files to send.

The program will now make all the necessary checks for errors and, if successful, you can save the invoice by clicking on the item Fillet (top left) and selecting the option Save Invoice give the menu check if you press.

You can, if necessary, resume the invoices saved using the command Open Invoice from the menu Fillet. Finally, I remind you that the generated invoices must be sent to the AdE via the Invoices and Payments web panel (which must be accessed upon requesting a specific PIN, as I explained to you in my tutorial on creating CCF files).

Assoinvoice (Windows/macOS/Linux)

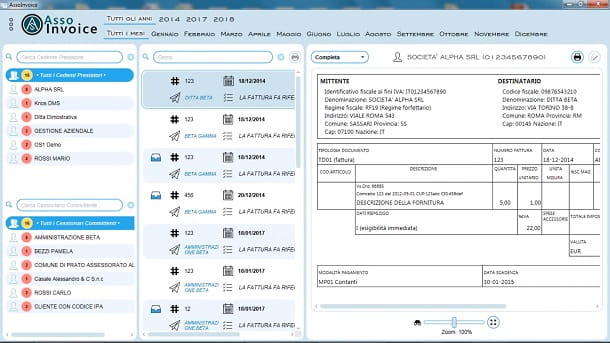

I will now talk to you about another free program, however, designed only for viewing electronic invoices and not for creating them: it is assoinvoice, freely downloadable from its official website, by clicking on the blue logo (below) corresponding to the operating system you use on your PC. Assoinvoice is in fact available as well as for Windows, also for MacOS e Linux.

In this guide I refer to the Windows version, but if you want to know how to download Assoinvoice for macOS or Linux, check out my guide on how to open XML electronic invoice.

Once the download is complete, open the .exe file obtained and then proceed by clicking on the button NEXT. Provide, then to accept the terms of the contract, click on the button again NEXT, choose the folder where to install the program, click again on NEXT and confirm the software installation by clicking on the button Install.

At the end of the installation, click on the button Finished and open the software from the menu Start (the one accessible by clicking on the button located at the bottom left, the one with the Windows logo).

When the program opens, it asks you to accept the license and terms of use: you confirm, with two clicks on the buttons I approve. Now you just have to click on the icon (⋮) (top) and select the button in the shape of a folder, to be able to select the path where the electronic invoices you want to view are located. Then confirm everything by pressing the button Select folder.

When the invoice is displayed, you can also change the view mode between simplified, complete e Ministerial. Finally, you can save the file or print it, by clicking on the appropriate icons located at the top.

Libero SiFattura Basic (Web)

To be taken absolutely into consideration too Libero SiFattura Basic, a complete and free management program that allows you to create xml files of the electronic invoice, as well as to directly receive electronic invoices. More info here.

Paid electronic invoicing programs

Now that I have introduced you to the programs offered for free to manage electronic invoices, I move on to tell you about those available for a fee.

The choice is very wide but here I preferred to focus on the most used and widespread ones at the moment. These software are particularly suitable if you need to use electronic invoicing frequently or to use a specific service.

In many cases, in fact, it is all-in-one solutions which work directly from the browser and which also send the invoices issued and received to the Revenue Agency.

So, are you ready to find out which ones are the best? Well, make yourself comfortable and read on to find out more!

Aruba e-invoicing program

The first paid program to manage electronic invoices that I tell you about is the one provided by Aruba, a famous 2022na company that has been operating for years in the sectors of online practices, Web hosting and the cloud: it is undoubtedly one of the most used, thanks also to the fact that it manages the entire electronic invoicing process, from creation to communication to the Revenue Agency, as well as archiving and any printing.

What is more, the program works entirely via the web, so you won't need to install anything on your PC and it's also accessible from a convenient one mobile app Android and iOS / iPadOS which allows you to have your electronic invoices always at hand, with the ability to create, send, receive, manage and store them just like from the web application.

From an accounting point of view, the Aruba Electronic Invoicing it also allows you to communicate data relating to periodic settlements of VAT and the transmission of the relevant invoice data spesometro ed stereometer.

The Aruba service is offered in its version Complete intended for owners of VAT number at a price of 1 euro + VAT for 3 months and then 25 euro + VAT per year on renewal: includes 1GB of space for document management (equal to approximately 100.000 invoices with an average weight of 10KB); receipt of invoices via Recipient Code KRRH6B9; access to the management panel; import of invoices from other systems and the AdE portal; automatic conservation according to law; preview of received and sent invoices; editor for creating and uploading XML invoices; sending invoices to individuals, customers and public administrations; management of suppliers, customers, products and services, payment, etc .; sending invoices and financial communications and transit through SDI; online collaboration with your accountant, multi-user management (optional for a fee) and electronic orders (optional for a fee). More info here.

For owners of Tax Code and for all those who only need to receive electronic invoices instead the service is available Aruba Electronic Invoicing Receipt Only which, at a price of 1 euro + VAT for 3 months and then 14,90 euro + VAT per year on renewal, offers 1GB of space for documents; receipt of invoices using the Recipient Code KRRH6B9; access to the management panel; the ability to set up the sending of automatic reports; importing invoices from other systems and from the AdE portal; automatic storage according to law; preview of received invoices and multi-user management (optional, for a fee). More info here.

It is also possible to enrich Aruba Electronic Invoicing withmulti-user access and the purchase of additional space. Multi-user access allows autonomous access (with specific credentials) to the Aruba Electronic Invoicing service by additional users, who may have different permissions: Read, Create / Modify (not provided for the Receive Only service), Send invoices (not provided for the Receive Only service) and Manage settings. The price is 4,90 euros + VAT / year for each user. The purchase of additional space, on the other hand, amounts to 25 euros + VAT / year for each GB. More info here.

It should be emphasized that Accountants e business studies they can manage customer invoices and accounts directly online independently with a dedicated management panel. In fact, they will be able to register a free account that will give access to a customer management area and will offer them the opportunity to collaborate or operate on behalf of the customer, based on the permissions granted, ranging from simple consultation of documents to creation, issuance, modification and management of invoices, receipt of financial notifications and communications on behalf of its customers and configuration of the billing service. All free, thanks to the service Electronic Invoicing Aruba Accountants More info here.

That said, if you want to use Aruba Electronic Invoicing, connected to the dedicated page, click on the button Buy Now and complete the order by logging in, if you are already registered; alternatively, if you need an Aruba account, click on the button Sign Up and complete the order. Remember to indicate a choice between freelancer, company, individual company o Public Administration and fill in all remaining personal information, email address included.

Before clicking on the button Continue and complete the order, remember to tick the consent box on the treatment of privacy. At the end of the procedure, just complete the payment via credit card, bank transfer, bulletin o PayPal. You can check on this page the activation time in relation to the type of payment chosen.

When you have obtained access to the service, you will be able to use the Aruba Electronic Invoicing services directly from the Web or from the app, with very intuitive interfaces and welcome tutorials that will help you take your first steps. For all the details, I invite you to consult my complete guide to Aruba Electronic Invoicing, the YouTube channel with video tutorials dedicated to the operation of the service and the Aruba Magazine, which contains many interesting news related to the world of electronic invoicing.

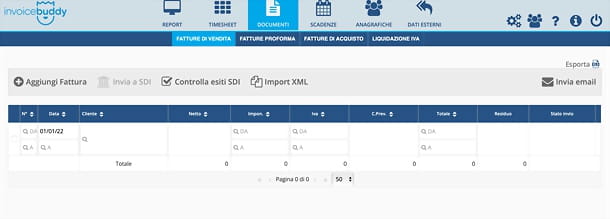

InvoiceBuddy

If you work in the world of services and, therefore, in a certain sense "sell your time", I strongly recommend that you consider InvoiceBuddy: a great online billing software specifically designed for service activities (freelancers, professionals, consultants, agencies, work groups, etc.) with the aim of optimizing the time dedicated to the billing process, not "going crazy" by reconstructing the various activities carried out and not risking "losing on the way" the work carried out.

Among its main features, which distinguish it from other billing software available on the market, is the presence of a integrated timesheet, which is directly linked to the billing module. This means that there is no need to record the activities carried out on an agenda, an Excel sheet or on the calendar and then report them in the billing software: the activities are recorded directly in the InvoiceBuddy timesheet and these are automatically listed in the billing form for be billed.

InvoiceBuddy also allows you to easily track the hours spent in carrying out a job and to understand if the amount requested in the estimate was sufficient to cover the time spent; see i customers with arrears with related amounts and deadlines; manage and monitor i reminders; organize activities to be performed, deadlines and roles with an effective task manager; to achieve turnover forecasts and much more. All this with the possibility of multi-user access (with or without limitations), in order to manage the activities and track the time of multiple people working on the same project. More info here.

InvoiceBuddy has several plans to choose from: Novice Buddy (4,99 euros / month + VAT billed annually) which is ideal for those who fall into facilitated tax regimes such as minimums and flat rates and includes time tracking, generation of invoices and proformas, sending invoices via e-mail in PDF, exporting invoices in XML and an evolved schedule; Expert Buddy (11,99 euros / month + VAT billed annually IN PROMO FREE FOR THE ENTIRE 2022) which is ideal for those who must use electronic invoicing and includes sending / receiving electronic invoices, expenses classified by type, monthly income and expenses plan and turnover analysis; and finally the plan Guru Buddy (18,99 euros / month + VAT billed annually IN PROMO FREE FOR 3 MONTHS) which is ideal for work groups and, in fact, features multi-user access with unlimited users, payment reminders, import bank transactions from home banking, reconciliation of receipts and payments and analysis of the profitability of projects and customers. More info here.

To activate your free trial, just connect to the main page of InvoiceBuddy, enter yours email address in the appropriate field and click on the button to request the try for free. You will receive by e-mail the instructions to access the software from your favorite browser with the relative ones credentials.

Once logged in you will need to fill in the form with i your business data, after which you can start using the timesheet and all the other functions offered by InvoiceBuddy. Everything is organized in a very clear and convenient way with, at the top, the toolbar for quick access to Report (with dashboard, forecast and customer analysis) Timesheet (with activity and billing), Documents (sales invoices, proforma invoices, purchase invoices and VAT settlement), Deadlines (collections, payments, transfers, account statements and advances), registries (of customers, suppliers and banks, plus tariffs and services) e External data (with reconciliation and tracked settings).

In short, it is all very intuitive and you will not have any difficulty in taking your first steps in the various screens of the software. In any case, be aware that clicking on the icon of the Question mark at the top right you can access a rich section of video tutorials which detail how InvoiceBuddy works. For more information, I refer you to the official website of the service.

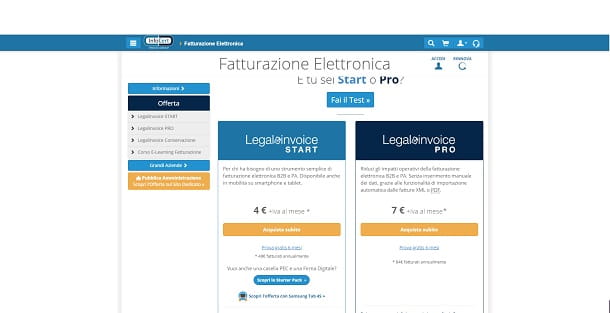

Legalinvoice e-invoicing program

Another program I want to tell you about, also available for a fee, is that of InfoCert named Legalinvoice. This software too works via the web, via any of the supported web browsers. Another advantage of Legalinvoice is that of do not require digital signature because it is InfoCert who signs, as an intermediary, the invoice and sends it to the Sdi of the Revenue Agency.

As for prices, Legalinvoice is available in two versions, respectively called START e PRO. Both versions offer a complete service but with the difference of addressing a different type of user.

With the version START, ideal for artisans, traders, farmers and VAT numbers who turn to an intermediary for accounting management and issue invoices created manually or via PC, it allows you to manage invoicing to and from the Public Administration and individuals (B2B). Furthermore, the software allows you to manage the sending of invoices with the relative checks, make estimates, transport documents, schedules and access functions to export documents, as well as receive invoices via the InfoCert channel or your PEC mailbox.

Legalinvoice START also includes an automatic storage archive of electronic invoices, sent and received. If you choose to try it, a free period of 6 months, to then pay € 4 per month + VAT (billed annually), for a number of 200 invoices sent or received from the Sdl. You can get more information by clicking here.

Speaking, instead, of the version PRO, this is the ideal solution for businesses, companies and studios that already have management or ERP software with which to create invoices (PDF and XML-PA) and want to use a tool for managing B2B invoices without the need to modify the billing already used. The functions and advantages of the START version are included, but the function of import of invoices generate to ERP systems.

The user screen includes data control entries and functions for exporting data and invoices, even in large numbers. The free trial period offered is 6 months, to then pay € 7 per month + VAT (billed annually) for the management of a total of 400 documents (invoices, DDT, credit notes, etc.) sent or received via Sdl. You can get more information on this page.

If you choose to contact Legalinvoice, proceed with the registration at the dedicated site, then select one of the two services (START o PRO) and confirm that you want to activate the 6-month trial service. Next, do theaccess to the InfoCert account, or proceed by clicking on Create an account and fill out the form with address email e Password, and then tick I'm not a robot and choose whether to give consent for marketing activities. Then click on the button Sign me up, per proceeding.

Then reconfirm your intention to activate Legalinvoice free for 6 months with the address of your preference and click the button Attiva. The next step requires entering personal data, choosing the type of Activities (private, company, trade association, freelance or worker in the PA), then gives consent and click on NEXT. Finally, remember to specify the e-mail address to receive confirmation of the activation and double click on the buttons NEXT.

Please note that, to purchase Legalinvoice, you must connect to the official website and select, through the appropriate drop-down menu, the duration of the subscription and number of invoices that you intend to create for this period, and then click on the button Add to Cart. The next screen relates to the order summary, where you can check your information and purchase information and then click on Proceed with payment.

As for the use of the software, it is in itself very intuitive, thanks to the fact that the interface is very practical. In addition, its use is practically guided. For example, you can fill in the company profile and the electronic one to get started, and then adjust the settings on the user profile and public profile, after which all you have to do is choose between the procedures for creating invoices, consultation or archiving and printing.

If you want a detailed guide on using Legalinvoice, I suggest you refer to my tutorial dedicated to the service.

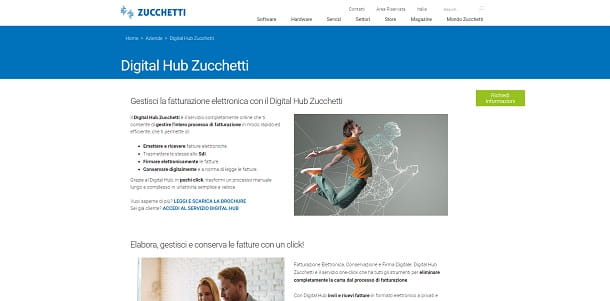

Zucchetti electronic invoicing program

The last solution I want to tell you about in this guide is the one proposed by Zucchetti, for the management, sending and storage of electronic invoices.

Zucchetti offers two possibilities for electronic invoicing: the first is called Zucchetti Digital Hub and it's software Web based suitable for all those who want to have personal access to the management of B2B and PA invoices, leaving the storage task to Zucchetti. The other solution is called Outsourcing/pay-per-use, i.e. the delegation of the entire management, transmission and storage of electronic invoices. In both cases, no installation is required, the program can be used directly from a web browser.

Zucchetti Digital Hub also includes access to the Digital Hub app, designed to issue electronic invoices from smartphones and tablets, the automatic sending of the identification code to customers and suppliers, the automatic redirection of invoices to your PEC and the management of fuel purchases through ZcarFleet.

The purchase of Zucchetti Digital Hub is possible through this page, from which you can choose the type of business you carry out and proceed by choosing a package of invoices ranging from euro 10 + VAT for 10 invoices until euro 400 + VAT for 1000 invoices. Before you can make the purchase, you must register by clicking on the button first Buy Now, then on the voice Not registered? Click here! and completing the proposed form. Finally, decide whether to give the consent to privacy and, having completed everything, click on the button Sign Up.

Zucchetti's Outsourcing service works with a prepaid model which involves the purchase of packages of invoices (active or passive) with a variable price based on the number. Each of the packages has a duration of 12 months from the date of purchase. You can consult the complete price list at this address. Once you have identified the package you want, you must proceed by purchasing the SDI card: a prepaid credit with valid for 24 months rechargeable and usable in several installments.

To purchase an SDI card, you must go to the dedicated page, choose theamount to be paid and insert the login credentials (or register, as already seen for the Digital Hub). After accepting the terms of use, you have to fill in the section CHOOSE PACKAGE and make your choice, so that the credit on the card is deducted.

The use of Zucchetti's electronic invoicing management software package is rather intuitive, and there is also an exhaustive user manual on the electronic invoicing service that manages to dispel practically any doubts about it.

Free Invoice Lite and Pro (Web)

These are the most complete versions of Free SiInvoice: add further features, such as the automatic sending of electronic invoices to the SDI and the possibility of sending electronic invoices to the PA. More info here.

Article created in collaboration with Aruba and InvoiceBuddy.

![[Review] Samsung Powerbot VR7000: the robot vacuum cleaner from Star Wars](/images/posts/6bc44de38605b5c0fa12661febb1f8af-0.jpg)