I opened my last one checking account con N26 and I think it took me about 10 minutes to do it. A totally different experience from the one I lived in a classic country branch over ten years ago. No waiting, no endless documents to read and sign, no people trying to convince you to even apply for a credit card you don't need. Here is ours review of N26 Bank.

But what is N26?

N26 a "smartphone banking". This is because you can open and manage an account using only a mobile device. Don't worry, the absence of branches does not mean that the company is not reliable. In fact, N26 has had a European banking license since 2016 and currently operates in 17 Eurozone countries, serving over 500.000 customers.

This revolutionary bank was born around two concepts: design and technology. The aim is therefore to offer users a secure current account but able to keep up with the times, making the management of their money absolutely intuitive thanks to a clean and modern interface.

Opening an N26 current account: the steps to take

But let's get to the point: how do you open the N26 current account?

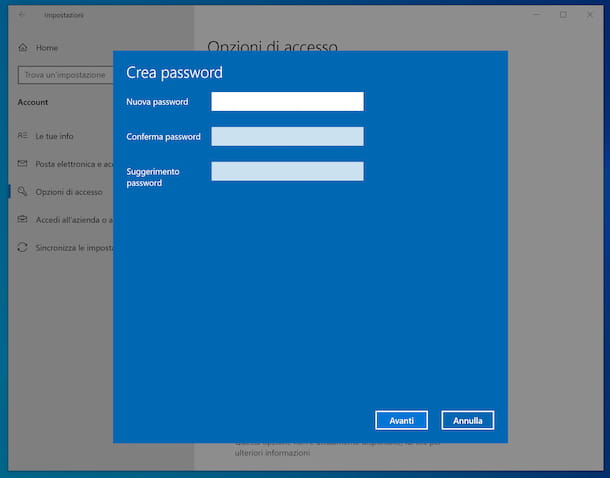

First of all you have to visit the dedicated site and click on "Open account ". At this point you will need to enter a series of basic information: name, surname, date of birth, residence and contacts; once finished, confirm that you want to proceed and that's it, or almost. Before you can use your new bank account - with German IBAN - it is necessary validate your identity.

Don't worry, this time too the process will be painless. In fact, to proceed you will have to download the dedicated application, available for both Android and iOS, and then queue up for a video call with the operator who, I guarantee you, will very politely pretend not to notice that you have been out of bed for 30 minutes. and you're still in your pajamas. Before starting the call, however, get yourself a valid identity document because, during the very short interview, the customer service will have to take a photo of the identity card (paper or electronic) or of the passport.

Et voila, now you are ready to enjoy your new checking account. But how? Of course you are free to receive and make transfers but also to use the associated debit card. Yes, you got it right. The opening of the N26 account requires the receipt at home, within a few days, of a card of the same name - belonging to the circuito Mastercard - to use for your daily shopping, both online and in all physical stores.

The convenience of a "pocket" bank

However, N26 is not a "smartphone banking”Just because you can open your account in 10 minutes using your phone and an Internet connection. In fact, the definition also refers to the management of your money.

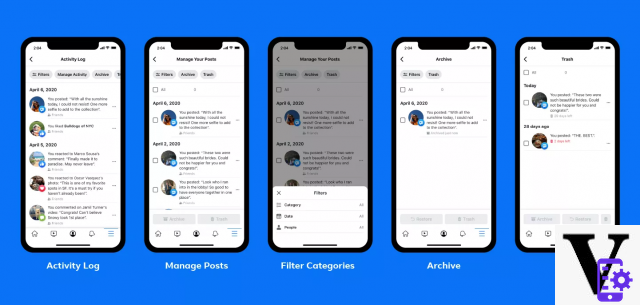

The application for iOS and Android primarily includes the list of all transactions carried out. Each of them can be associated with one or more tag and even to one photo; also available a series of category which are assigned automatically but which you can always change later. What is it for? It is soon said. Inside the application you will find a menu called Stats which collects all your expenses, divided by type. In this way it will only take you a few seconds to understand which were the most notable releases of the month.

However, the functions of N26 do not end there. Indeed, among the most interesting features we find the possibility of receiving real-time notifications on each transaction, compatibility with Apple Pay,'' sending wire transfers and, especially, MoneyBeam. This is a feature that allows you to send money instantly to your contacts, provided of course they are N26 customers.

IF YOU WANT TO TRY N26, USE THIS LINK TO GET 15 EUROS CREDIT * TO GET IT YOU MUST SPEND 15 EUROS WITH THE CARD

Imagine you are out for dinner with a friend. At the cashier they tell them that I can't make a split bill so, for convenience, pay the person you dined with. Instead of running to the first ATM to withdraw, just use the application to pay off the debt.

However, MoneyBeam also works in reverse. This means that if someone owes you money, you can send them a request for money that the other party can accept by simply tapping on the notification.

Finally, I would like to point out the possibility of manage your debit card. The application of N26 in fact allows you to block it in the house if it is stolen or lost and then order another one. If you want, you can then reset your PIN, impose withdrawal and payment limits and even enable or disable online payments, those abroad and cash withdrawals.

One bank, four checking accounts

I know, you are wondering how much this all costs. In reality, I cannot give a single answer as this German bank has four different types of current accounts.

The most common is that Standard. IS entirely free, allows you to withdraw without limits and without commissions throughout the eurozone, has no cost for transfers in euros and uses the official Mastercard exchange rate for POS payments around the world, without additional surcharges.

Then there is the current account N26 Black. The benefits are the same as the standard account but this time you will have a black debit card, the insurance coverage included and the possibility to withdraw without limits and without commissions even in foreign currencies. However, N26 Black has a cost of € 5,90 per month.

N26 Metal instead it presents a Mastercard with a tungsten heart, boasts a dedicated customer service and gives you access to a variety of exclusive conditions offered by partners such as Tannico, Talent Garden, Home24, GetYourGuide, Hotels.com and IHG. Of course, as the advantages increase, the cost also increases: N26 Metal costs € 14,90 per month. But be careful: the Metal account is not yet open to everyone. At the moment the German bank is inviting a selected number of N26 customers to register for priority access, but rest assured, in 2018 it should also become available to all other customers.

Finally, the last available account is that Business, dedicated to freelancers and freelancers. The features are similar to those of the standard version but in addition you will be entitled to a 0,1% cashback on all purchases.

IF YOU WANT TO TRY N26, USE THIS LINK TO GET 15 EUROS CREDIT * TO GET IT YOU MUST SPEND 15 EUROS WITH THE CARD

Why use N26? Our opinion.

I've been using N26 for over four months now and can't do without it anymore.

I use N26 for most of my online purchases - from food on Just Eat to books on Amazon -, I use it on the go to pay for shops, restaurants, supermarkets and train tickets and I consider it a great substitute for cash when it comes to paying small debts with friends. N26 is also useful at work. Instead of giving my main IBAN for wire transfers, I provide N26's, so I don't even have to bother adding funds to my account.

The user experience offered by the German bank is absolutely unique. The interface, intuitive, snappy and minimal, allows you to immediately find what you are looking for, without going crazy among a thousand different options. The customer service is also excellent, with operators who speak strictly Italian and who are ready to answer any question.

In short, N26 is an alternative to the usual banks, un'alternativa gratuita, sicura, versatile e moderna. If you haven't signed up yet, I recommend that you do so as soon as possible. I'm sure you won't regret it.