Le classic banks usually, they offer checking accounts that in adthetion to the normal fees, they have many expense accessory, making these accounts (when it comes to calculating the total) not very cheap and convenient compared to the classic postal book.

Not everyone knows, but it is possible save focusing on current accounts managed by banks that operate mainly online. In this article, updated monthly with new offers, I'll show you both the thefference between a checking account and a deposit account, what you need to look at before choosing an online account and what is even more important the best online current accounts available at the moment. We have structured this article in the most complete and functional way possible, thevitheng it into the following parts.

INDEX

- Difference between current account and deposit account

- How to choose an online checking account

- Best online account

- User preferences survey

Difference between current account and deposit account

Many do not know the thefference between current account and deposit account and, although to the eye they may seem two similar services, they have obvious thefferences.

BANK ACCOUNT

Il checking account it is a banking instrument that the applicant can benefit from, to deposit their own income (from work or other sources) and then spend them with one of the tools made available by the bank. The classic tools with which you can spend the money stored in the current account are:

- Bancomat type payment card (with thefferent circuits, the most used are PagoBancomat and VPay)

- Domiciliation of utilities (the old therect debit, now SDD)

- Checkbook

- Wire transfers (online or over the counter)

Alongside these tools, there may be additional services such as:

- Crethet card (with thefferent circuits)

- Crethet line (sums that can also be used with a negative current account)

- Interest on the amounts paid

Normally all these services have a cost to be maintained, but banks that operate only online (or that operate online with small offices instead of huge banks) offer only part of the services (essential ones) for free or at very low prices, thus meeting to the needs of users who do not want to spend too much to maintain their current account.

In a typical online bank you will always have the following services:

- Bancomat type payment card

- Domiciliation of utilities

- Wire transfers (online only)

These are offered free of charge by any online bank; to save money, this bank will not offer you a credit card (but could provide it upon request), a credit card, a checkbook or interest (practically non-existent on online accounts, except for special promotions). There are also other services that could be offered for free such as the payment of F24s, but they vary from bank to bank.

DEPOSIT ACCOUNT

Il deposit account is a banking tool where it is possible move sums of money in the form of a "deposit" without the possibility of using them to pay bills, make transfers or withdraw money with the payment card. They are a sort of "piggy bank" in which you can move money from a current account (to which it must necessarily be combined) to generate savings. Interest is normally applied to the deposit account, so as to accrue the savings (at the end of the year, if you have not touched the sums deposited, you will have more money).

The deposit account can be of two types:

- Free: the sums deposited can be re-transferred to the current account at any time.

- Bound: the sums deposited are blocked for a specific period of months (usually 6 or 12 months) and you will not be able to transfer them back to the current account (unless the restriction is removed).

The escrow account offers higher interest than the free deposit account or the simple current account, so it can be seen as a good way to accrue the money you intend to set aside as savings (figures that you absolutely do not want to touch).

How to choose an online checking account

There are many services and parameters to consider when choosing an online current account. Those that turn out essential, which should never be missing, are the following:

- Payment card (Bancomat) with free withdrawals throughout Europe or around the world (you can withdraw for free from any ATM)

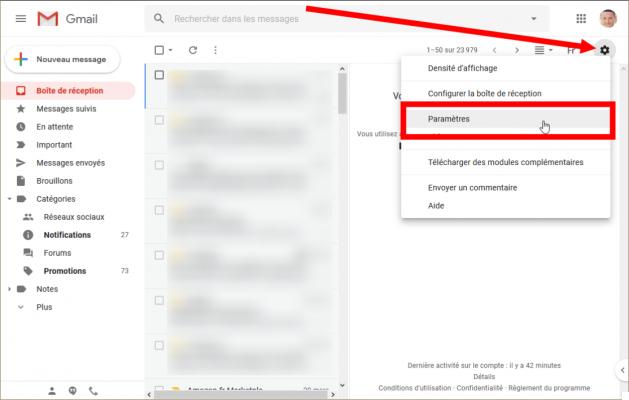

- Home banking service with security codes

- Current account access via smartphone or tablet app

- Stamp duty of 34,20 euros per year, free for average stocks of less than 5.000 euros

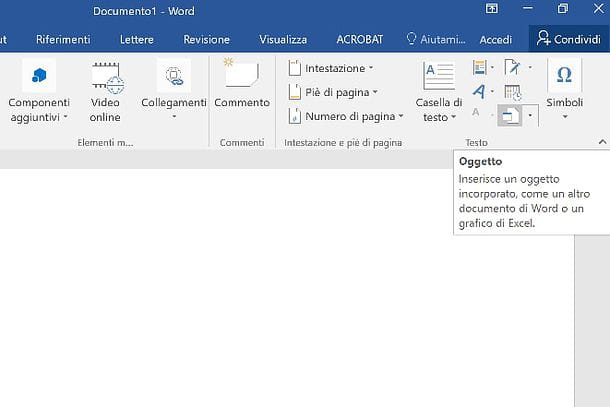

- Main online operations (bank transfers, F24 etc.) free of charge

- Alert service for movements from the payment card (SMS, email or push notifications)

- Free domiciliation management (SDD)

Online banks could also offer you other ancillary services for free, but these are the ones that must be present to make the choice of the online current account better than any current account managed by a classic bank.

Best Online Account of August 2021

After explaining the thefferences between current account and deposit account and the parameters to be evaluated in the choice, I will show you the best online current accounts that you can activate to start saving.

The current accounts listed here are 8, that is a wide choice among which to find the one that best suits your needs.

N26 Current Account (N26 Bank Germany Group)

N26 is the innovative current account, which can be opened via smartphone app with a German bank (i.e. N26 Bank) in 8 minutes. Easy and quick to use, manageable from your smartphone and available with 4 thefferent types of accounts: Standard and Business which are free and Metal and Black in which additional paid services are available. Prepaid card and ATM withdrawals are free if made in euro currency or with 1,7% commission if in foreign currency.

You can get more information and, if necessary, request this card from the link below:

LINK | Account N26

Créthet Agricole city current account (CariParma)

Another online account you can open is Conto ora, offered by the Cariparma bank (now in the Créthet Agricole group). This bank offers an account with zero monthly fees and zero activation costs if you use Nowbanking Privati, the service that allows you to carry out all transactions via internet banking, mobile and telephone. In adthetion to this account, it now offers a debit card (Easy Cash Bancomat with free fee, 24 free withdrawals per year in other your language banks, the possibility of receiving periothec reports in electronic format, the CartaSi Classic MasterCard credit card with free fee for the first 12 months, the domiciliation of the users and, in case of need, a branch always at your thesposal.

You can get more information and, if necessary, request this card from the link below:

LINK | Créthet Agricole city current account

Webank Current Account (Banca Popolare the Milano)

Among the best online banks there is Webank, or the online channel of Banca Popolare the Milano, which offers an advantageous current account with a monthly fee of only € 2, zero management fees and perfectly compatible with any smartphone thanks to the innovative app. The bank offers free online transfers, a PagoBancomat and Maestro Contactless debit card with free withdrawals at the ATMs of all banks in the city and in the Euro area, rechargeable cards and credit cards (on request).

You can get more information and, if necessary, request this card from the link below:

LINK | Webank account

HYPE Current Account (Banca Sella)

If you are looking for a card with all the advantages of a current account but at no expense, you can bet on HYPE, the online bank of the Banca Sella group. The activation costs are free, as is the fee for the HYPE Start account; in adthetion, the bank offers a debit card of the MasterCard circuit with free withdrawals in all ATMs in the city and in the world, free stamp duty, free online transfers and the possibility of setting aside small amounts automatically to create your savings in simple and comfortable way.

You can get more information and, if necessary, request this card from the link below:

LINK | HYPE

The best fiber optic offers of August 2021 The best fiber optic offers of August 2021 Fiber optic is currently the most advanced and powerful technology in terms of speed and stability in terms of internet connections, a technology that is gradually replacing

The best fiber optic offers of August 2021 The best fiber optic offers of August 2021 Fiber optic is currently the most advanced and powerful technology in terms of speed and stability in terms of internet connections, a technology that is gradually replacing Witheba Current Account (Monte dei Paschi the Siena)

Another interesting current account offer is offered by the Witheba bank, part of the Monte Paschi the Siena group. This bank offers an online current account with zero activation fees, zero account management fees, Apple Pay support, free ATMs and credit cards, free withdrawals throughout the city, PEC and thegital signature included, free online banking and up to € 500 of amazon.it gift vouchers.

You can get more information and, if necessary, request this card from the link below:

LINK | Witheba

Current account Hello! Money (Hello Bank - BNL)

If you are looking for a zero-fee credit card, with all the advantages of an online current account you can bet on the HELLO account! MONEY, offered by Hello Bank (or the online bank of BNL, BNP Paribas Group). You can do everything online, from activation to top-up, without ever having to go to a branch. Account opening, online transfers, mobile phone and prepaid card top-ups are all at no cost, as are withdrawals from BNL and BNP Paribas ATMs, as well as in-store purchases via POS. The card supports the MasterCard Contactless technology, which allows you to pay without entering the PIN for amounts of less than € 25 and allows you to make online purchases safely with the single-use OTP codes to authorize any transaction.

You can get more information and, if necessary, request this card from the link below:

LINK | HELLO! MONEY

Orange Current Account (ING Direct)

With ING Direct you can have a current account with all the main free services. The account is available at zero annual fee (with average stocks of less than 5.000 euros), offers the possibility of obtaining a debit card (Bancomat), a credit card and a prepaid card (virtual, excellent for online purchases) without paying activation costs and fees to maintain them.

In adthetion to cards, it offers free debit card withdrawals from all ATMs in cities and in Europe thanks to the VPay circuit and all the main free operations from any supported platform (web, mobile and app). The bank mainly operates online, but it also has numerous branches where you can deposit sums of money, request additional services and schedule a cash withdrawal. Next to the current account it is also possible to activate Conto Arancio, the deposit account with convenient constraints and zero management costs.

The account can be maintained even without spentheng a single euro for its standard management, but if you want to get the SMS alert service for the debit card you can activate it by paying 20 euro cents for each sentheng.

You can get more information and, if necessary, request this card from the link below:

LINK | Orange Current Account

Best Online Insurance for cars and motorcycles of 2021 Best Online Insurance for cars and motorcycles of 2021 More and more people are choosing to take out online insurance for their car or motorbike, given the considerable savings on quotes compared to common physical insurance under the same conthetions. In

Best Online Insurance for cars and motorcycles of 2021 Best Online Insurance for cars and motorcycles of 2021 More and more people are choosing to take out online insurance for their car or motorbike, given the considerable savings on quotes compared to common physical insurance under the same conthetions. In User survey

Other items that may interest you:

- NFT: what they are, how to buy them and how to invest in them

- What are Bitcoins

- How to buy Bitcoins

- The 10 best cryptocurrencies to invest in

![[Review] Samsung Powerbot VR7000: the robot vacuum cleaner from Star Wars](/images/posts/6bc44de38605b5c0fa12661febb1f8af-0.jpg)