That of the Crowdfunding it is an established practice that in recent times has transformed projects and ideas into reality that only a few years ago would hardly have seen the light. The real estate crowdfunding, a collective financing system similar to generic fundraising which however has the objective of acquiring a real estate.

This practice has been spreading more and more in recent years and is making available a part of the real estate sector that would otherwise have been accessible only to people with large capital. But how exactly does Real Estate Crowdfunding work? and what are the best dedicated platforms?

Real Estate Crowdfunding: the best platforms

How Crowdfunding works is very simple and now clear to everyone: a project or idea is proposed on the web to ask users to offer a loan to start it. In return, users receive a prize or a particular gift which can be a preview of the product or a participation fee in the company (depending on the amount of money paid).

Crowdfunding has extended to the real estate sector witharticle 50 of the law decree of 24 April 2017. This small change extends the crowdfunding system to SMEs as well, as it is no longer limited to innovative startups in Italy.

With this expansion of the market, many were born and arrived in Italy Crowdfunding platforms real estate that offer interesting opportunities, let's find out some!

Bondora

Bondora is an Estonian platform founded in 2009 that offers the possibility of financing loans. All citizens of the European Union can register on the platform and start investing with very few funds at rates that are, on average, around 10% gross per year.

To date, the platform offers four investment modes:

- Go & Grow – The investment method recommended for newbies. After starting your own account, simply select the amount to invest, any monthly deposits and duration of the investment. Then the system automatically configures the most profitable investment strategy and will buy autonomously on the market. The system only invests in short-term loans and you can close your investment at any time

- Portfolio manager – It is a more customizable solution than the previous one with which it is possible to decide the level of risk and therefore the return of our interest. Also in this case, the system distributes the sums to be invested independently according to the different risk classes

- Portfolio PRO – This solution is suitable for more experienced investors. In fact, it offers a much higher number of settings that will have to be selected personally by the investor after which Portfolio Pro will independently take care of the investment process

- API - The application programming interface (API) allows advanced programming users to create a custom investment application. This is the most efficient and most complex way to build your own investment algorithm

It goes without saying that all these solutions can be adapted to any type of investment including real estate.

Crowdestate

Crowdestate is the leading real estate crowdfunding platform in Europe with over 40 investors and 228 funded projects. The platform intends to offer a complete range of financing to overcome the accessibility difficulties that traditional banks offer today.

With Crowdestate it is possible to start a fundraising campaign in no time, once the project has been approved. Each idea is in fact carefully examined and if necessary, the platform provides useful suggestions and information to best present the project. Any request can be sent on the dedicated form whether it be loans, fundraising or instruments related to the real estate market.

Crowdestor

Crowdestor it allows SMEs to raise capital from individuals and businesses and to invest in both real estate projects and entrepreneurial activities. The platform boasts over 11 investors and an average interest rate of 15,36%.

It is a fairly secure system that guarantees income regardless of the success of the project. If this has not been fully funded, the platform still ensures the interest rate for the days elapsed between the investment and the expiration of the fundraising campaign. Added to this is also the possibility of accruing the interests from the moment of the start of the investment, without having to wait for the project to be further financed by other actors.

Depending on the proposed project, the platform itself can become an investor with a share ranging from 2 to 10% for each project. All information can be found on the Official Website.

EstateGuru

EstateGuru is a more mature platform, born in 2013, which has beyond on its side 40 investors and 1300 successfully funded projects.

The platform is characterized by a great simplicity and speed of use. All you need to do is create an account, verify your identity and bank account details and start investing. We will have a virtual portfolio in which to insert the sum to invest without any limit. You can either select the projects to finance yourself or take advantage of the function Auto Invest, configure it according to your needs and let the technology work for you.

It is also possible to propose your own projects that require a loan in which it will be necessary to specify the target to be reached, the interest rate and all the details relating to the idea. A EstateGuru manager will contact you personally to guide you step by step through the actual registration process. Once approved, the platform will agree the financing conditions with you in order to propose the project to investors.

The funds raised will be made available only and if the requested sum is reached.

Re-Lenders

Re-Lender is an Italian real estate crowdfunding platform which, as its name suggests, promotes the financing of conversion projects to give new life to old buildings. It is therefore not just about residential properties but also industrial, urban and environmental reconversions, energy and so on.

The platform includes two types of collective financing:

- Civic Crowdfunding – For the refurbishment of buildings of common interest in the area

- Lending Crowdfunding – A form of investment for those looking for a return on the loan

Re-Lender it is a clear and easy to use platform. To start investing, simply register for free on the official website and complete the validation process by uploading an identity document. Once the verification has been carried out, you can immediately start investing in the best reconversion projects by receiving interest monthly.

DO YOU WANT TO TRY RE-LENDERS? CLICK HERE!

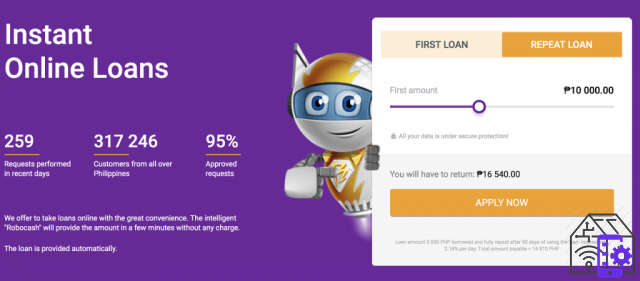

Real Estate Crowdfunding:Fastinvest and Robocash

Festinvest e Robocash are two platforms peer to peer dealing with short-term loans, from a minimum of 1 month, or 3 months for Robocash, up to a maximum of 1 year.

Festinvest e Robocash are two platforms peer to peer dealing with short-term loans, from a minimum of 1 month, or 3 months for Robocash, up to a maximum of 1 year.

- Fast Invest is a FinTech company founded in 2015 that caters exclusively to private investors from the European Union who want to invest in consumer loans issued by credit institutions. To apply for a loan, simply fill out the application form. A lending institution will check all documents and verify a risk assessment. If everything is in order and satisfactory, the institution grants the loan. The verification is done three times and certified for the investment by a credit institution. At this point, the Credit Risk and Compliance Department of FAST INVEST approves the conditions of the creditor. Funds are automatically transferred to the FAST INVEST account. Through the tool Auto invest, you can automatically reinvest the funds you receive

- Robocash - The platform operates within the financial holding, whose companies have been active in the loan sector since 2013 and guarantees a high interest rate that can reach up to 13% per year. The Robocash Group uses automated technologies based on artificial intelligence and machine learning to ensure customer comfort and efficiency for companies with a totally autonomous system. Over 5 million people have become customers of the group and over 4,3 million loans have been issued

Real Estate Crowdfunding:Group e Mintos

Grupeer and Mintos make it possible to invest in guaranteed corporate loans, issued by market professionals.

These are two platforms in P2P lending. They therefore connect people who want to lend money, so-called borrowers, with people or companies that need it, called lenders. Every project you can invest in is protected by the BuyBack guarantee. This means that if there is a delay in payments of more than 60 days, the companies will buy back the loan itself.

The lenders who currently use Grupeer are about 15.000 and a total of 55 million euros have been financed. Mintos, on the other hand, having more years behind it, has accumulated around 280 investors distributed in 66 countries.

Housers

Housers allows you to invest in the real estate market with a minimum capital of 50 euros.

We are in the presence of a platform of "P2P crowdfunding”, All members participate in the purchase of the asset by financing certain companies that will worry about investing in that particular project. Those who adhere to the loan, therefore, do not obtain a participation fee in the purchase of the property but an annual return on the basis of agreements reached at the beginning of the investment.

Moneyfarm

MoneyFarm is a real one Independent Financial Advisor at your service to support and manage any type of investment with a dedicated professional.

With the online registration, the financial situation, the objectives to be achieved and the risk profile will be analyzed, in order to create a personal investment plan with the right exposure to risk. The system of Moneyfarm deals with investment operations: from the purchase and sale of instruments, to the analysis and daily monitoring of the markets, so as to generate a “passive” income.

Swaper

Swaper is a platform born in 2016, which aims to provide European investors with a guided approach to the short-term consumer credit market. With Swaper it is possible to create automated investment portfolios to make passive investments. Also in this case, certain investments are protected by the BuyBack guarantee.

Currently the platform matters almost 4 thousand active investors for a total of 143 million invested.

Viainvest and Viventor

Viainvest and Viventor are both intermediary platforms that connect investors with mortgage applicants by offering clear and safe opportunities.

Viventor offers free, flexible and diversified access to capital and investment opportunities for investors. All loan authors available on the crowdfunding platform are professional financial service providers, compliant with all regulations. The platform offers a annual interest of around 16%, one of the highest among the peer to peer platforms in Europe.

Viainvest it is a very clear and simple platform whose peculiarity lies in the fact that almost all the loans have a duration of one month and all have a rate of 11% and buyback insurance.

The opportunities of Real Estate Crowdfunding

All these platforms offer a variety of opportunities that can adapt to any need whether it is about interests, automation or investment duration. By the nature of the investments themselves, none of them are risk-free, but with the right approach and support from each platform's team, it is possible to limit the dangers and amplify the opportunities for each investor.

![[Review] Samsung Powerbot VR7000: the robot vacuum cleaner from Star Wars](/images/posts/6bc44de38605b5c0fa12661febb1f8af-0.jpg)